All Categories

Featured

Table of Contents

Like any financial investment item, annuities include special advantages and disadvantages: Annuities can supply surefire earnings permanently. Guarantees are based on the claims-paying capability of the life insurance coverage business. Other retirement earnings alternatives have limits on just how much you can deposit yearly. Annuities do not. Due to the fact that they're invested in different ways, annuities usually provide a higher ensured price than various other items.

You pay taxes when you obtain your annuity earnings, and no one can forecast what the taxed rate will certainly be at the time. Annuities can be difficult to recognize.

How do Annuity Payout Options provide guaranteed income?

Deposits into annuity contracts are normally secured for a period of time, where the annuitant would incur a charge if all or part of that money were taken out. Each sort of annuity has its very own special benefits. Finding out which one is right for you will certainly depend on factors like your age, threat resistance and just how much you have to invest.

This product is a blend of its repaired and variable loved ones, and that makes it a little extra difficult. The interest rate paid to annuitant is based on the efficiency of a specified market index. With an indexed annuity, you have the chance to gain higher returns than you would certainly with a dealt with annuity with more security versus losses than with a variable annuity.

Who provides the most reliable Annuity Investment options?

Getting one can help you feel a sense of financial safety in retired life. One advantage to annuities is the fact that they can supply guaranteed income for an established number of years, or even for the rest of your life.

In these scenarios, you can believe of an annuity as insurance versus possibly outlasting your savings. For employees that do not get a pension, an annuity can help fill up that void. Employees can spend money into a pension (like an IRA) and after that, upon retirement, take those financial savings and acquire an annuity to supplement Social Protection.

What is the best way to compare Annuity Payout Options plans?

Another huge advantage provided by annuities? The money you add expands tax-deferred. This suggests you don't pay tax obligations on the interest up until you begin getting the funds, usually after you begin retired life. All certified annuity withdrawals are subject to regular income tax, and withdrawals taken prior to the age of 59 will certainly incur an additional 10% tax penalty The tax-deferred condition can permit your cash to have more development potential or permit your money to possibly grow more with time due to the fact that gained passion can intensify without any kind of funds needing to approach tax settlements.

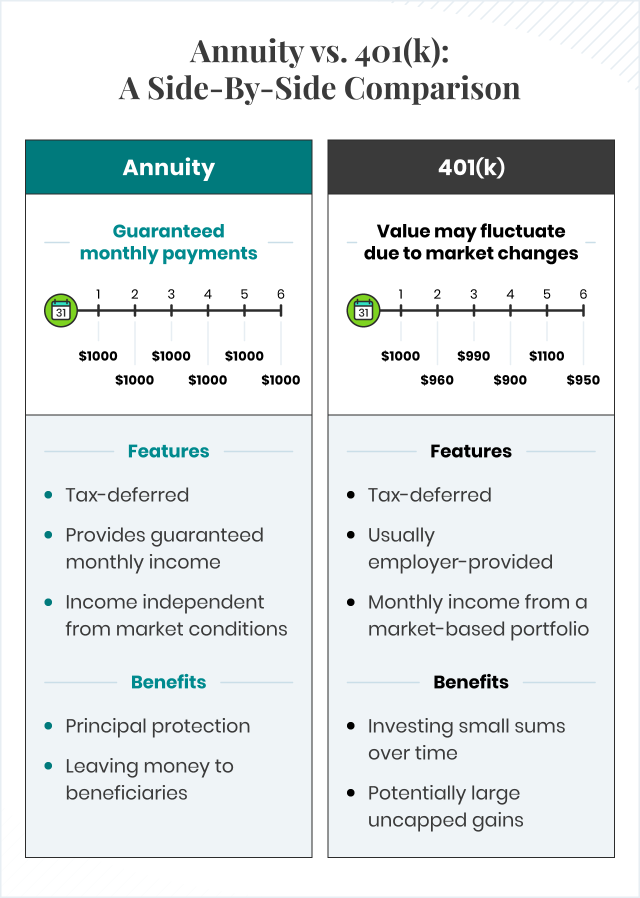

Unlike other retirement choices, there are no IRS limitations on the quantity of money you can add to an annuity. The IRS places caps on the quantity you can purchase an individual retirement account or 401(k) each year. For example, the 2024 limitation for an IRA is $7,000 a year or $8,000 if you're 50 or over.

How do I get started with an Income Protection Annuities?

1 But the IRS does not position a ceiling on the quantity you can add to an annuity.

There are prompt annuities and deferred annuities. What this suggests is you can either purchase an annuity that supplies settlement within a year of your premium or an annuity that begins paying you in the future, normally upon retirement. There are also annuities that expand at a set price, or variable annuities that grow according to the performance of financial investments you have in a subaccount.

Rider benefits, terms and conditions will certainly differ from cyclist to cyclist. Long-lasting treatment insurance policy can be costly or difficult to get for those with pre-existing problems or wellness concerns. This is an area where annuity advantages might provide owners a benefit. With an annuity, you might have a choice to acquire a cyclist that permits you to get greater settlements for an established time duration if you call for lasting treatment.

It's only a guaranteed quantity of income you'll receive when the annuity gets in the payout phase, based upon the claims-paying capability of the insurance provider. With any kind of financial choice, it's great to understand and evaluate the costs and advantages. If you would like to know what are the benefits of an annuity, remember it's a sensible choice to save tax-deferred money for retired life in a manner that suits your demands.

Who provides the most reliable Tax-efficient Annuities options?

Many people select to begin receiving these payments either at or sometime after retirement - Fixed vs variable annuities. Annuities have a whole host of names, based upon advantages and providing firms, however at their core, they are best understood by their timeline (immediate or deferred) and whether they consist of market direct exposure (variable). An instant annuity allows you instantly transform a lump amount of cash right into a guaranteed stream of earnings.

Table of Contents

Latest Posts

Highlighting Fixed Annuity Or Variable Annuity Everything You Need to Know About Financial Strategies What Is Fixed Annuity Vs Variable Annuity? Pros and Cons of Various Financial Options Why Annuitie

Analyzing Pros And Cons Of Fixed Annuity And Variable Annuity Everything You Need to Know About Pros And Cons Of Fixed Annuity And Variable Annuity Breaking Down the Basics of Fixed Annuity Or Variabl

Understanding Fixed Vs Variable Annuity A Comprehensive Guide to Investment Choices Breaking Down the Basics of Investment Plans Features of Smart Investment Choices Why Fixed Interest Annuity Vs Vari

More

Latest Posts